If you’re reading this article, chances are you either currently use Salesforce Revenue Cloud, or you’re looking to.

If so, take a moment to ask yourself: what drove you to purchase (or consider it)?

At risk of sounding too on the nose...Revenue, right? We think it’s safe to assume that your Revenue Cloud investment hinged on the expectation that your business’s revenue growth would accelerate. Salesforce doesn’t name their products just anything, after all.

Revenue, it turns out, is one of those pesky numbers that business leaders always want to see increasing. This leads us to the ultimate question (and likely the reason you clicked on this article): how can you increase the value that you get from Salesforce Revenue Cloud?

How To Get More Value Out of Salesforce Revenue Cloud

Salesforce Revenue Cloud is made to manage and accelerate your revenue growth. But to really start shaking all the green we can out of it, we need to dig into the weeds a little bit. How does it accelerate revenue growth? Understanding the details makes it much easier to use them to your advantage.

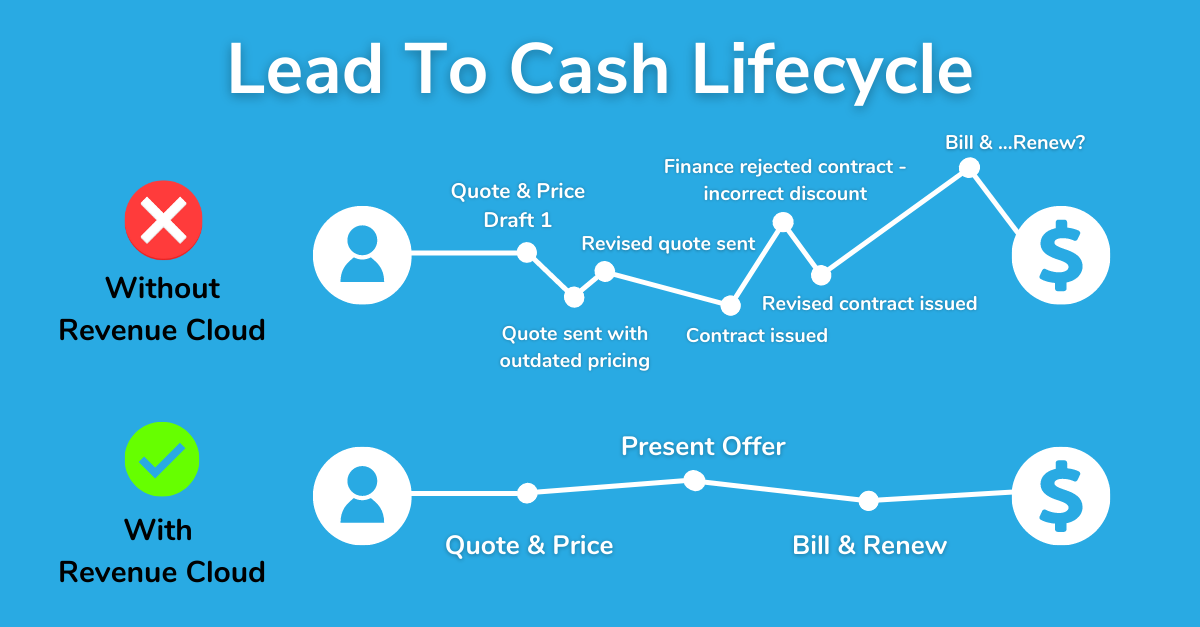

To make things simple, we’ve created a short infographic.

In essence, Salesforce Revenue Cloud makes the sales process much easier -- for your employees, and, by extension, your customers.

Your sales teams can easily put together complex deals with multiple product categories, pricing structures, and discounts -- leading to faster and more accurate quotes and invoices -- leading to deals that get approved by finance the first time.

Your customers can’t see this well-oiled machine on the backend, but they can feel it. Instead of trudging through the sales cycle for weeks only to end up with misaligned quotes and invoices, they receive a smooth experience -- leading to faster payment and increased loyalty.

Increasing your Salesforce Revenue Cloud ROI is a matter of enhancing the ways in which it smooths out the lead-to-cash lifecycle.

You Might Also Like: How To Improve The Customer Experience With Salesforce

Identify The Gaps In Your Current Lead-To-Cash Lifecycle

So what does smoothing out your lead-to-cash lifecycle mean? Here’s a quick screenshot we grabbed from Google:

The key is creating a revenue lifecycle that’s “free from perceptible projections, lumps, or indentations” (maybe not so literally -- but you get the picture).

Salesforce Revenue Cloud takes care of a lot of the smoothing-out:

But it’s still not a perfectly straight line. We need to identify the gaps in your lead-to-cash lifecycle, and then implement solutions to smooth them over.

Pretend Like You’re Implementing Revenue Cloud For The First Time

A good way to identify the gaps in your processes is to take a step back and reevaluate. Imagine that you’re planning to implement Revenue Cloud for the first time -- what are your goals? Common ones might include:

- Reducing sales cycle duration

- Increasing quote accuracy

- Increasing win & renewal rates

You Might Also Like: Salesforce Data Security Best Practices For Financial Services

How did you originally see Revenue Cloud functioning with your processes? Sketch out your ideal workflow from start to finish, as if you’re planning an implementation. Does it look like what you’ve actually got now?

For example, maybe you wanted to reduce friction between Salesforce and your ERP system. Sketching out your ideal integration might make you realize you wanted to be on tier 4 in this image, but you’re only on tier 2.

Source: Salesforce & Simplus

Close The Gaps

After identifying the bumps in the road, the next logical step is to patch them up. Sometimes, this will involve new configurations within Revenue Cloud itself, such as enabling Advanced Approvals for Salesforce CPQ.

When Revenue Cloud falls short, you’ll need to venture to the pothole-patching shop: aka, the Salesforce AppExchange.

Billing (like Digital Route’s usage-based billing app), accounting (like Accounting Seed), and payment gateway apps (like Blackthorn Payments) are all common solutions to enhance certain gaps left open by Revenue Cloud.

However, we know of one solution category that nearly any Salesforce Revenue Cloud customer can use to enhance their processes and close the final gap between lead to cash: document generation and e-signature apps.

You Might Also Like: Upgrading Your Document Generation System? Here's What You Need To Know

How Document Generation & E-Signature Enhances Salesforce Revenue Cloud

Document generation and e-signature solutions like S-Docs close a glaring gap in Salesforce Revenue Cloud -- the ability to send on-brand, accurate documents like quotes, MSAs, and invoices at any time during the sales process, and create binding agreements with signature collection.

Wait, you might be thinking. Salesforce Revenue Cloud allows you to create quotes and invoices -- that’s what CPQ & Billing is for. Right?

While this is true, document generation & e-signature solutions close a gap left open by CPQ & Billing and render their limitations obsolete. Let’s break it down.

Create Any Type of Document, Anytime

Salesforce Revenue Cloud may help you get your quotes and invoices out the door, but odds are your sales cycle requires more than that. Document generation solutions like S-Docs allow you to create any type of document and send it out -- at any point in the lead-to-cash cycle -- with one click (sounds smooth as silk to us).

Create More Powerful Documents

Sure, Salesforce Revenue Cloud helps reduce the complexity of pricing out complex deals. But in the end, especially for larger deals, complexity can’t always be avoided.

Document generation solutions allow you to create quote and invoice templates that can merge data from anywhere in Salesforce and contain thousands of line items. 100% native solutions like S-Docs (built on the Salesforce platform) are especially good at getting this done quickly -- we’re talking 100,000+ invoices in under a half hour quickly.

They can also help you out with complex dynamic content -- like different T&Cs merged in based on the product configuration or any other business rule you could think of.

You Might Also Like: How to Create A Professional Quote in Salesforce

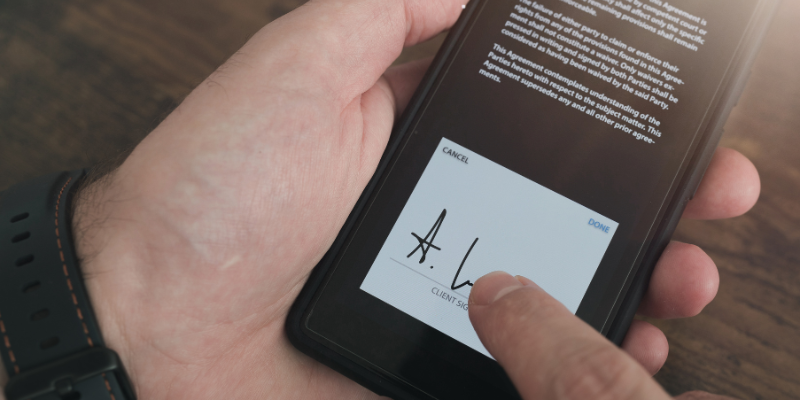

Seamlessly Collect E-Signatures

There’s no getting around it -- Salesforce Revenue Cloud doesn’t provide e-signature functionality. You could find an outside app to integrate with your CPQ & Billing templates, but that adds another layer of complexity.

Combined document generation & e-signature solutions will let you create document and e-signature templates using the same system. You can configure and price deals, send quotes and invoices for signature, and track their progress -- without missing a beat. Smoothing the gaps.

Stay Professional & On-Brand

Document generation solutions give you the power to create quotes, invoices, and other documents that you can be proud of. You aren’t limited by CPQ templates when you use document generation -- meaning you can create truly customized documents that reflect your business.

Quotes and invoices are often the first formal impression a customer gets from a business -- so it’s important to make them count!

Salesforce Revenue Cloud: Keep The Gaps Closed With 100% Native Apps

Salesforce Revenue Cloud can be an incredibly valuable tool that nets you improved revenue processes and a smoother lead-to-cash cycle. Upping your ROI means identifying the biggest benefit Revenue Cloud brings to your business, and then figuring out how to close the gaps and enhance that benefit.

100% native Salesforce apps like S-Docs are positioned to help you get more out of Revenue Cloud without adding complexity or clutter. Since they’re built on the Salesforce platform, they’re already seamlessly integrated into the system your team depends on every day.

For more information about how S-Docs for Salesforce Revenue Cloud can help accelerate your lead-to-cash workflows, request a demo today or reach out to sales@sdocs.com.

.png)